A while ago I wrote about using a 0% balance transfer offer to earn a little extra money buy putting the transferred money into a high yielding savings account. There are technically no rules against this and although the interest would not be substantial (probably would amount to about $300), it would be "free money". I was ready and determined to avoid any sneaky fees that the credit card company might try to charge me. I was not ready however, for the endless delays that they would subject me to.

I called the credit card company and told them that I wanted to wire transfer $23,000 into my checking account. Unfortunately, the thing I did not know was that in order to request a wire transfer, you have to call from your home phone number. When I moved, I had failed to update the number on my account and the old number had long been disconnected. I updated the phone number and would have to wait another 30 days for the change to take effect. It was frustrating, but understandable. They were only trying to look out for me, right? She suggested that I simply write one of the checks and take it to my bank to deposit it.

That is exactly what I did. The only problem was that when I tried to deposit the check, they informed me that they would charge a $15 processing fee and would hold the check for 5 weeks to make sure it was legit. Apparently, banks have a dislike for checks from credit card companies. I fussed and fought but they were not budging. So I politely told them to shove it and left without cashing the check.

I waited and waited thinking of all the interest earning time that was passing by. Finally, I figured that it had been 30 days and called back to get my money. Everything seemed to be going fine. $23,000 is nothing to sneeze at so of course when I called and talked to the customer service rep they asked me to answer a number of security questions to verify that I was who I really said I was. He told me I should have my money in about a week. Finally!

Every day I would check my account online, waiting for the transaction to go through. Then one day I tried to log into my account and nothing was there. Panicked, I called them. They had placed my account on hold because they suspected fraudulent activity. (I know you can't see me right now but just imagine me rolling my eyes.) So I answer the security questions again and he cheerily informs me that my account should be back online in 30 minutes. Greeeaaat.

The next day, I log online and still nothing. I call back and go through the same ordeal.

Them: Did you recently initiate a balance transfer?

Me: Yes. I have already talked to two different people about this.

Them: O.k. ma'am. Well do to a high volume of fraudulent activity we need you to answer some security questions.

Me: Fine. But I've already answered these questions twice already.

After a series of exceedingly annoying questions, they confirm that indeed everything is legit (for the third time) and say that they will restart the balance transfer process and that I should get my money in a week. This is where I lose it.

Me: You told me a week ago that I would have my money in a week. Now you're saying that it is going to take another week?

Them: Well we had to put your transaction on hold because there were fraud concerns.

Me: Were you ever going to call and tell me this? Remember, I had to call you to solve this problem.

Them: We sent you a letter.

Me: A letter? I'll probably get that in a week. Couldn't you have at least called if you were seriously concerned about fraud?

Them: Um, we did. But we couldn't get a hold of anyone.

Me: Did you leave a message?

Them: Um, actually they said you didn't live there anymore.

I am so completely irritated at this point that I tell them to forget the whole thing. What was the point of me updating my phone number over a month ago if they can't even get the phone numbers straight in the first place? I won't even torture you with the back and forth exchange I had with these people about why they were calling the wrong number.

My theory is that they drag out the process as long as possible so you have the money at the 0% rate for a shorter amount of time. They used to give you 6 months or some predetermined amount of time to have the money at the lower interest rate. Now they do it so you only have it until a specific date. And not to mention that although they say that you have until say September 20th, they really mean that you have until September 20th or before the pay cycle that includes September 20th. This means that if you wait until September 19th to pay it back but your pay cycle begins September 18th, you are already too late.

It was a good idea but not made for a person with low tolerance for annoying customer service. I just couldn't stand the thought of having to call them and answer more security questions. Another victory for the credit card companies. But at least I don't have to sleep with the enemy anymore.

Friday, March 31, 2006

My 0% interest scheme was a flop

Thursday, March 30, 2006

Ever wonder...

what is the point of signing when you use your credit card? Does it really matter how you sign? Do you ever just get lazy and scribble your name? I always wished I had a cool doctor's like signature but alas, my signature takes me a good 15 seconds to execute. Every letter is clearly drawn, nice and neat. 15 seconds may not seem like a long time but it feels like an eternity when there are people practically pushing you out of line because they are in a rush to be next. These people clearly don't appreciate perfect penmanship. Would it really matter if I just quickly scribbled anything, just to seal the deal and get the heck out of the way?

Well, I happened across this funny article from Zug about someone who tried just that. Not necessarily because he (or she?) was in a rush but because (s)he wanted to see if people were paying attention. (S)he even went so far as signing with a grid and a stick figure. I got quite a laugh out of it. Next time I buy something with my debit card, I'll have to try it and see what happens.

Monday, March 27, 2006

Throw away the fashion mags

For a while I held on to the fashion magazines. I lived vicariously through the glossy pages, envisioning myself in the clothes or with the new lip gloss. I figured it was harmless because I wasn't actually buying anything but I was wrong. Really, I was just torturing myself with stuff that I wanted but could not have.

You see, I now look at fashion magazines the same way I look at malls. They are evil. Pure and simple. They are evil because they are loaded with ridiculously expensive things that alter your perception of what is affordable and what is not. My eyes nearly bug out of my head when I see the price tags of some of the items. $2,000 for a handbag, $800 for a pair of shoes, $550 for a sweater. It makes it so that when I see a pair of shoes for $220 I think they are a bargain! It builds us up to a false sense of practicality. Comparatively the $220 pair of shoes are a much better buy than the $800 pair of shoes so you are making a frugal decision, right?

Not to mention that fashion magazines are designed to make you feel, well, bad. Ever notice how in those "what's hot, what's not" sections, the what's not was what was hot last month? So now that you've run out and bought the latest trend you have to hide it in your closest or risk being passé and drag yourself back to the mall to buy what is hot this month. And the cycle repeats and repeats and repeats. You can never win.

Along with banning the mall I am now banning fashion and beauty magazines as well. I'm not saying that all magazines are bad. Just the ones that try to sell an impossible lifestyle. Magazines should be inspirational, educational and informative, not a test of willpower.

Maybe it's time to start subscribing to a personal finance magazine instead so I will be more tempted to save instead of spend!

Saturday, March 25, 2006

This is the thanks I get?

Last night I parked my car under a tree in front of my apartment. When I went down to my car this morning imagine my shock and horror when I found my car looking like this...

Keep in mind that when I left my car last night it was bird poop free. I looked around at all the other cars and not one of them had one drop of bird poop on them. I had parked in this spot and never had an incident like this before. Clearly, my car had been maliciously attacked by angry birds. They used the weapon they know best, their feces.

"Why?" you ask. I can tell you why those little buggers attacked my car. You see, it all started with trying to make my cat happy. We moved here from a place that was full of birds that my cat could watch from the window. Bird watching was her hobby. In our new apartment she had nothing to watch except a parking lot full of cars and the occasional person walking by. She was depressed and bored so I bought a bird feeder hoping that we could attract some birds to our balcony.

Months passed and no birds came. I tried everything to keep her happy. DVDs of birds, remote control mouse toys, I even contemplated getting another cat to keep her company. Nothing worked. Then one day I noticed that some of the bird food had been eaten and later I noticed that 2 little birds would come and eat out the feeder. My cat was finally happy.

2 birds turned into 4, 4 turned into 6 and soon I could have upwards of 16 birds on my balcony at any one time.

The birdy party crashers were eating me out of house and home. I would put food out when I got home from work and by the time I got home from work the next day the food would be completely gone. I went through a whole bag of birdseed in just one week. I tried to space out the feedings so that I wouldn't have to buy as much bird seed.

I ran out of bird seed and on my trip to the store I forgot to pick up more. I contemplated making a special trip but couldn't justify the effort for the birds. Apparently, the birds didn't like my decision. After 4 days of not having a refill, they decided to show me exactly how they felt about me.

You may be thinking that the bird poop happened because I had attracted these birds to my balcony in the first place. But I argue that I had never had a problem with a soiled car when they were regularly fed! Coincidence? I think not.

So I'm off to get an expensive car wash (I have not had any luck finding a cheap car wash around here) and some bird seed to mollify the angry birdy powers. I have learned my lesson.

Friday, March 24, 2006

Blogs from the Financial Front

Hooray! They finally have the link up to the article at Money Magazine featuring the "Five online money diarists too smart--or weird--to miss". Am I the smart one? Or the weird one? Hmmm. ;) Regardless, I was pleasantly surprised to be mentioned along with:

Sound Money Tips

All Things Financial

Another F@cked Borrower

Change is Good

And thanks to Bailey from Thoughts from the Change Race for providing a scan:

Thursday, March 23, 2006

Bill Re-Evaluation

The whole fiasco with my auto insurance reminded me of the importance to re-evaluate all of my bills. It has been a while since the last time I really went over what all my monthly bills were and whether or not there were ways I cut back. So in the past week I have been doing some thinking and have decided on a couple of money saving sacrifices:

1) After comparing all of the auto insurance companies I decided that Unitrin was the most cost effective and reliable insurance companies, even with the additional $40 fee for renewing my policy. Even though I couldn't get that fee waived, after changing some of my coverages to what was more approriate (lowered bodily injury liability and dropped towing and rental car expense coverages) I was able to save $40 off of my premium.

They had also increased the per payment fee from $3 to $5. So I decided instead of paying on a monthly basis I would just pay for it all up front. This will hurt the debt repayment in the short term but after the initial hit I'll have more money per month to pay towards the credit card.

2) I cancelled my subscription to Audible. I don't commute anymore so I don't have any real need for audiobooks and I have a ton that I haven't listened to yet. That will save me $15 a month.

3) I changed my student loan repayment schedule from the most agressive repayment plan to the least expensive per month. That will free up an additional $50/month to put towards the credit card. While this may not save me any money (either way it would have gone towards debt) it will help me out mentally by speeding along the process of paying off the credit cards. Once the credit cards are paid off I'll be able to focus all of my energy towards paying off the student loans.

The end is near, I can almost taste it. The closer I get, the more excited I get and hopefully making these few small changes will help me along my way.

Getting to Know...Me

Head on over to the NCN Network to read a little email interview with none other than yours truly. Find out why I started to blog, what my long term personal finance goals are and much more than you ever needed to know about me.

Wednesday, March 22, 2006

My Day of Salvation

I tried to calculate the exact day that I will be out of debt based on my pay schedule and when my bills are due. Based on my calculations I should make my last credit card payment on August 4, 2006. This is assuming I don't receive any extra cash before then and I don't have any major unexpected expenses. That means that I have 162 days until I am debt free!

Tuesday, March 21, 2006

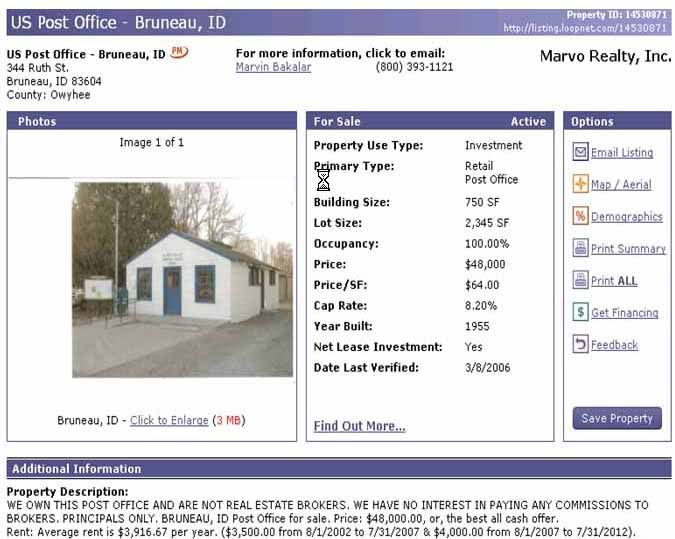

An unusual real estate investment choice

Tonight I sat in on a very introductory course on real estate investment. A lot of the stuff I already knew but one thing that struck me as unusual was one of the property types he suggested for beginners. In addition to the usual suggestion of purchasing a condo, a single family home, a multifamily home like a duplex, or a small retail space he suggested buying a post office.

I didn't even know that you could buy a post office. I assumed that the government would own the building and the land that they operate the post office on, but I was wrong. Anyone can buy a post office and lease it out to the U.S. government.

Think about it. What a sweet deal that would be! The biggest drawback that I have always envisioned for owning investment real estate is that you have to deal with people, people who don't pay their rent and who don't care about maintaining the property. If the U.S. government is your tenant most likely they are not going to be throwing wild parties and they will have the money to pay you rent (well, lets hope so because if they don't we're all in trouble).

Here are some of the advantages to owning a post office:

*Rent to a Stable tenant

The U.S. government usually signs 5 year leases so you are guaranteed the income for at least 5 steady years. Most post offices tend to stay in the same location year after year. When was the last time that your post office moved?

*Tenant responsible for all expenses

You won't have to worry about them running up the electric bill because they have to pay for it.

*Post offices are everywhere.

This means that there are plenty of cheap locations to choose from.

*Easy to manage.

Post offices are pretty self sufficient so there is no need to hire a property management company that will cut into your cash flow. Also, you can buy out of state and not worry about having to visit the property often.

A quick search on a commercial real estate search engine produces this affordable post office in Idaho. Only $48,000 to buy with an 8.2% CAP rate (rate of return on your investment).

So it all sounds good, huh? What are some of the disadvantages?

*If the post office decideds to not renew its lease, you'll have a hard time finding another tenant to replace them. If that happens you'll most likely be able to only sell it for its land value.

*It's hard to find financing.

*The U.S. government is hard to negotiate with. You'll have a tough time trying to raise the rents on them.

Not a bad deal if you ask me. It's better than having to deal with clogged toilets and evictions.

Sunday, March 19, 2006

What $300,000 + Buys You in…Orange County, CA

JLP over at All Things Financial started a post on what $300,000 will buy you in the real estate market in his neck of the woods and has encouraged other PF bloggers to do the same. O.k. I'm game...but can you really buy anything in Orange County (Irvine) for $300,000?

The answer is yes, but you're not going to get much! The closest thing I could find to $300,000 was this "spacious" 1 bedroom, 1 bath upper-unit condo of 643 s.f. for $299,900.

Now maybe you can understand why I feel like I will never own a home unless I move out of the state.

Just Say No to the Mall

The mall is an evil place. Walking into a mall is like walking into a vortex where your money is sucked straight out of your wallet, or even worse, money you don't have is charged to a credit card.

The mall is an evil place. Walking into a mall is like walking into a vortex where your money is sucked straight out of your wallet, or even worse, money you don't have is charged to a credit card.

O.k. Maybe I am being a little dramatic in saying that the mall is evil, but I definitely feel there is something sinister about a mall. The mall has a way of casting a spell over me while I am there. Things that I didn't even know existed are all of a sudden a necessity and my entire wardrobe seems helplessly shabby and outdated in comparison to the fresh new styles on the racks of countless stores. I lose all sense of rationality and my old mantra of "You only live once" creeps back into my mind and I feel tempted to go on a wild shopping spree. This is why I now avoid the mall at all costs!

You see, I think a lot of Americans end up in debt out of sheer boredom. Go to the mall on any day of the week, especially Saturday and Sunday, and you will find throngs of people filling the malls, fighting over parking spaces and bumping into each other with their baby strollers. Why are they there? Surely all of these people don't need to be there. I think many of them just can't find anything better to do than to hang out at the mall and grab a Cinnabon or a hot dog on a stick. And while they are there passing the time, they end up spending money that don't have on things that they don't need.

I remember every Saturday my grandma and her sister would go to the mall. It was a sort of ritual they had. Rain or shine, regardless of whether they needed anything or not, we would all go to the mall and then go out to lunch afterwards. It's only now that that strikes me as bizarre.

I rarely go to the mall anymore and I've found that my desire for things in general has dropped considerably. For the most part I am content with what I have and can resist emotional or impulsive spending. Sure there are times when I feel the need for something new but its much easier to resist when I am far, far away from the mall.

So if you are in debt or are trying to save money, stay away from the mall. I suggest having a healthy fear of the mall. Think of it: rabid frenzied women pushing you out of the way to get to the big sale, no parking, bad food, and worst of all...money being sucked right out of your bank account, never to be seen again. Not my idea of a good time!

Saturday, March 18, 2006

How Much Car Insurance Do You Really Need?

I've been with Unitrin Direct auto insurance for the past year. They were the cheapest quoted when I went to www.insurance.com and when I switched to them from Mercury insurance I saved about $40 a month. I've never had any really problems with them...until now.

I received my renewal package in the mail and was looking through it to make sure they hadn't raised my premium and was even hoping they would decrease my premium. Neither really happened but what they did do was slap on a $40.00 "policy set up fee" to the total bill. What? A policy set up fee? Nothing on my policy had changed, nothing fancy is required of them. And to make things worse, they decided that they are no longer doing annual policies but instead are now only offering 6-month policies so in another 6 months when my policy renews I will have to pay another $ "policy set up fee." What BS!

Their policy set up fees will end up costing me another $80/year or about $6.60/month. I hate when companies nickel and dime you so that they can lure you in as customers and then try to squeeze as much money out of you as possible. It's more than principle of the matter more than anything. Why not include their expense costs in the premium instead of making it seem as if they are doing you a favor or providing you some additional service by renewing your policy? Isn't that exactly what their business is?

I called them and told them "NO THANK YOU" to the additional fees and they said "TOUGH LUCK." So I started shopping around for auto insurance.

I went back to www.insurance.com and got back a few different quotes, only 1 of which was less expensive than the quote at Unitrin. Annoying but the quote that was less was $108 cheaper for a 6 month policy than at Unitrin. All of the other quotes were

The quote was from Esurance so I decided to do a quick search to see what they were all about. I was so glad I did because I read numerous complaints from the Consumer Affairs website about them claiming that they gave them the run around when they submitted a claim or that they ended up raising their rates during the policy period for no good reason. I think I'll take a pass on them.

Here is what I don't get. I'm 24, never been in an accident, never had a ticket, have a good credit rating and only drive 4 miles one way to work. My car is pretty reasonable; it's about 3 or 4 years old, I own it and it is probably worth about $13,000. But for some reason I end up with ridiculously high quotes from insurance companies. AIG gave me a quote of something like $1,100 for 6 months or $183/month. That could be another car payment!

Maybe its time to reevaluate my coverages. There could be other ways to trim down my auto insurance cost which is my biggest expense after rent, credit card payment and student loans.

I found a good article on this subject at Smart Money. Here it is in paraphrase form with some of my own comments. I recommend checking out the full article as well.

Bodily Injury Liability

This will compensate the driver of the car and its passengers and passengers in your car when you get into an accident. The amount of coverage you need should be determined by the amount of assets you need to protect. This was news to me. I had bodily injury liability coverages of $100,000/$300,000 and I don't even have any assets besides my car. Unless they want to take me to court to win a portion of my credit card debt, I should really lower my coverages here. Smart Money recommends using their Net Worth calculator to determine the amount of assets you need to protect.

Property Damage Liability

This will help pay for the cost of damage to the other party's car. If you live in Orange County like me where too many people buy ridiculously expensive cars, you should have enough to cover the cost of that Mercedes or Porsche.

Personal Injury Protection

This will cover medical and funeral costs of you are passengers in your car regardless of whose fault it is. If you already have medical & life insurance you can be fairly safe in skipping on this coverage.

Uninsured or Underinsured Motorist

This will cover medical and funeral cost for you and your family if you get hit by a hit and run driver or with someone without any or enough auto insurance. A definite because of the number of people driving without insurance. It will make up for anything your medical insurance does not cover.

Collision and Comprehensive

Collision will reimburse you for the cost of replacing or fixing your car after an accident. Comprehensive will reimburse you for the cost of replacing or fixing your car in the event of a natural disaster, theft, or vandalism. It's best to choose the highest deductible available (usually $1,000) so that you can save on the amount your policy premium will cost you. In the long run, you'll only be paying more than $500 to reduce the amount of deductible you have. This is only of course, if you'll be able to pay the $1,000 deductible if you are in an accident.

If you have an older car it may make more sense to drop collision and comprehensive all together as these coverages can make up 30-40% of your total policy cost. If you get into an accident the amount of money you receive to replace or fix the car may not be more than you have already paid in insurance.

Car Rental and Roadside Assistance

The likelihood that you will need to use them are pretty slim. You'd be better off paying for them out of pocket if you do need them instead of paying a monthly fee just in case you might need them.

Unfortunately, even taking into account some of these changes, I still can't find a price that beats Unitrin and isn't shady like Esurance. It would be nice to move to a more reputable company like Geico or 21st Century but I would have to pay at least $40 more per month. In the end I just don't feel it is worth it. I guess I'll have to keep crossing my fingers and hope I don't get into an accident. And it gives me a reason to look forward to getting older...maybe when I turn 25 I'll start getting lower auto insurance rates!

Thursday, March 16, 2006

When you love your shoes too much...

I have a confession to make. I'm not really a shoe person. I'm one of those people that would walk around bare foot or in flip flops most of the time if I could. This works out great for me because I am not tempted like some people to spend an inordinate amount of money on shoes thus breaking the budget. I have other vices but shoes are not one of them.

Mainly I hate shoes because they tend to hurt my feet, especially heels. I've never gotten used to walking in heels and I always look ridiculous when I do. Just today, I tripped and nearly fell on my face 3 (yes three!) times because my heels got stuck on something or I twisted my foot the wrong way. Its fine as long as no one notices. I usually do a quick look-around to make sure no one saw and if I don't see anyone giggling then I'm cool. But its hard to play it off when you are trying to carry on a conversation with someone and all of a sudden you are immobile and your shoe flies off of your foot because it has gotten stuck in the floor (and yes, this did happen to me today).

I'm just not one of those girls who freaks out about shoes and wants to own 100 pairs of Prada or Jimmy Choo shoes. I have a hard time getting excited about shoes because I know that my feet will hate them and its hard for me to care how cute the shoes are when I'm in excruciating pain and falling all over the place. Even tennis shoes are hard to buy because it is so difficult to know whether or not they are going to be comfortable because they have to be broken in before you can truly know the nature of the shoe.

But alas, there is one pair of shoes that have always done me right. I bought them about 5 years ago and never regretted the $80 I spent on them. They carried me across Europe on a backpacking trip and I wore them just about everyday when I was in school and didn't have a car and walked everywhere. When I wear them I feel like I'm not wearing anything at all and they provide great ankle support so I can really hussle when I'm walking somewhere in a hurry.

They have looked terrible for a while now but I can't bare to part with them. I've washed them but they still look dirty and there are little plastic things that are falling off left and right.

I've bought other shoes since then but they don't compare. I feel like every time I buy another pair of shoes I am just wasting my money because I won't want to wear them. On the other hand, I don't want to wear the old shoes because they look beat. There comes a point when frugality must make way for fashion.

So what is a girl to do? I either buy new shoes which could be a waste of money (and money is tight) or I can just keep the old shoes and look, how do you say, ghetto.

I did have one other brilliant idea. I could just try to find the same old shoes for sale on the internet. Unfortunately, these shoes seem to be a rather rare find. I searched through tons of shoe listings on ebay but didn't have any luck finding the shoe.

I'm not sure what they are called but the bottom of the shoe has the words "Turbulence," "Duration," and "Max Air." Most of these brings up tons of shoes, not one of them being my shoe. The tongue of the shoe has the number 302308 which seems to be a product number because when I type it in I get results from some Asian website that has a picture of my shoe in red and gold. If only I knew what the heck the website said and they had it in the right color my life would be one step closer to being complete.

Oh mighty shoe gods...please help! These shoes must exist somewhere.

Monday, March 13, 2006

Reader Success Story

Have you ever seen the commercial that says "When banks compete, you win?" I'm not sure what company that commercial was for but it is so true! A Defying Debt reader recently shared her sneaky strategy of getting her interest rate lowered and I think it was such a wonderful idea that I wanted to pass it along to everyone.

Raven had over $65,000 worth of debt at the end of 2005 and now owes $49,000. That is an amazing feat in itself. If you do the math that is $16,000 paid off in just a few months, wow! The problem was was that she had one credit card with a balance of $14,700 with a whoppin 22% interest rate. She had tried numerous times to call the credit card company to have them lower her rate but with no success. I guess they knew they had her in a bind and they were not going to make things any easier for her (those bastards).

So she took matters into her own hands, contacted a bank that would let her take out a personal line of credit for $15,000 at 20% interest to pay off her credit card. Now that is all fine and dandy, 2% interest on $15,000 can add up. But she didn't stop there.

She then called the credit card company back and asked them what it was worth to them to keep her as a customer. They then offered her a balance transfer rate of 6.99% for the life of the loan!

Just by creating a bidding war between banks she was able to cut her interest rate down by 15%. That just proves the commercial right, when banks compete, you win!

I'm lovin it! Congrats to you Raven! Thanks for sharing.

Tuesday, March 07, 2006

Investing in Stocks: Part III

So far I've talked about choosing a good broker and reading a company's financial statements but haven't gotten into the really fun stuff yet. I've been reading lots of books from the library and listening to audiobooks about investing and I have to say that there are so many ways to evaluate a stock that I don't really know where to begin. I don't want to bore you with a bunch of terms and ratios. Those kinds of textbook explanations are much harder for me to understand and digest than an explanation that is dynamic and uses tangible examples.

The best way I think I can synthesize this information is to just break it down by the main points of each book and what information I thought was most useful and applicable.

The Warren Buffet Way

I love reading and learning about other successful people. I'm always hoping that just a little bit of what they have that makes them successful will rub off on me. Of course, when you think of successful investors you probably think of Warren Buffet, the second richest person in the United States. His net worth is over $40 billion (can you imagine?) so he must have been doing something right with his investments.

Apparently, Buffet followed in the ways of Benjamin Graham, who I had not heard of before but is considered to be the "Father of Value Investing" and wrote the highly influential book called "The Intelligent Investor," which is next on my books to listen to. Graham's method of investing is called "Value Investing" and taught that one should only buy shares in a company that are selling below their true value. Simple, right? But how exactly do you determine if a company's stocks are selling at a bargain price?

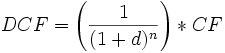

Buffet determines the value of a company by estimating the future cash flows of a company and then adjusting for the time value of money (or discount rate) based on the rate of a long-term U.S. bond. This is called the discounted cash flow and can be calculated with the equation below:

AGH! Equations, I know. I apologize for that. This is what equations do to my head: All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

Moving on.

Buffet is able to determine the future cash flows of a company by only focusing on companies that he understands and that have had consistent earnings power in the past. By focusing on companies that have consistent earnings and on companies where he understands the business he feels he can eliminate much of the risk that he can confidently project earnings into the future.

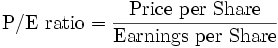

For those of us who aren't Warren Buffet and who don't have the experience of reading tons and tons of financial statements over many years, there are a bunch of ratios that people can use to determine if shares appear to be underpriced. The most popular one is the price to earnings ratio that I mentioned in a previous post. The P/E ratio can be computed:

P/E ratios are useful in comparing stocks between like companies, say if you are trying to decide between buying a share of Coca Cola or a share of Pepsi. The lower the number the better. Basically what it means is that if the P/E ratio for Coke is $10 you are paying $10 per dollar of earnings and if Pepsi has a P/E ratio of $15 then you are paying $15 per dollar of earnings.

Have I confused you yet? I think I'll leave it at that for now as all the numbers and equations are making my head spin. Please note that I am by no means an expert but rather I'm still trying to grapple to understand most of this myself. If you notice anything that is grossly erroneous, please let me know and if I make absolutely no sense, let me know and I'll try to clarify.

The good thing about trying to write this is that I can try to fill in the gaps in my understanding and I am learning a lot as I go. I hope you are getting something out of it too.

Saturday, March 04, 2006

Recovering from your mistakes

We only get one life. That's why it is so frustrating when you've made mistakes with the life that you were given. No one is perfect; we are all bound to make mistakes sooner or later. But sometimes it seems that the mistake of getting into debt is costing me too much of my life. The effects of debt have had repercussions on my life for years and will continue to cause repercussions for many years to come.

In ways, getting into that much debt (in May 2004 I had over $30,000 of debt) is one of the best things that have ever happened to me. I know it sounds crazy but I truly think that it had to come to such a dramatic climax to help me understand how important it is to save money for the future. Who knows when I would have realized the need to start saving for a house, retirement, etc. without it coming to that point.

Then again, I'm frustrated that all of this effort and sacrifice is being made just to pay off obligations; obligations that have left me with no real assets (except for my car, which doesn't really count because it is always depreciating). Wouldn't it be great if that $30,000 that I started off with could have been saved as part of a down payment for a house or the seed money for my own business?

Enough of that negativity! Gosh, talking about debt can be depressing sometimes. The most important thing to take away from this is what we can learn from our mistakes and how we can make up for the time it has cost us to repair those mistakes. Let’s face it. Anyone in debt like me has more of a disadvantage than someone who was smart with his or her money to begin with. So how can we make up for lost time? Here are some of the tips that I have come up with to take control of our financial futures:

1) Have a master plan.

The plan should not only include how and when you get out of debt but also what you are going to do after you get out of debt. This could include saving for a house, a business, emergencies, retirement, or all of the above.

2) Educate yourself.

Read tons of books (from the library). Read lots of blogs (especially mine!). Keep up with the news. Take a class on something that interests you. Getting educated not only helps you make more informed decisions but it will also keep you motivated to do the right thing. Besides, if you are constantly engaged in ways to better yourself, you will be less likely to be at the mall spending money.

3) Network with like-minded individuals.

People with similar goals will keep you on track and will hold you accountable for your actions. Not only that, but you can exchange ideas and assist each other in accomplishing your goals. I recommend that if you are also struggling to get out of debt to join the No Credit Needed Network. NCN has recently gotten himself out of debt and has started the network to encourage others to do the same. Imagine, a whole network of people cheering you on to attain your goal.

4) Always look for ways to learn a new skill or improve on your skills.

Having a large skill set will help increase your income earning potential. Whether it is by taking a class or by engaging in a hobby that helps you practice a skill (like blogging) you will be glad you did it. You never know when an opportunity to practice that skill might present itself.

5) Think big.

Most people laugh when I tell them that I want to buy a chateau (stop giggling!). It sounds so big, so unattainable but that is precisely the point. I probably could never have kept up my motivation to get out of debt if the end goal was to only get out of debt. Boring, right? There have been many times when I wanted to rebel and go on a wild shopping spree but then looked at pictures of chateaux and realized that my dream would be that much further away if I did. Dreams have to be big in order to keep inspiring us.

Debt can be the biggest blessing in disguise if we learn from it and vow to improve our finances. If you aren’t in debt, learn from my mistake and don’t do it!

Remember: “Success seems to be connected with action. Successful people keep moving. They make mistakes, but they don't quit.” ~ Conrad Hilton