So far I've talked about choosing a good broker and reading a company's financial statements but haven't gotten into the really fun stuff yet. I've been reading lots of books from the library and listening to audiobooks about investing and I have to say that there are so many ways to evaluate a stock that I don't really know where to begin. I don't want to bore you with a bunch of terms and ratios. Those kinds of textbook explanations are much harder for me to understand and digest than an explanation that is dynamic and uses tangible examples.

The best way I think I can synthesize this information is to just break it down by the main points of each book and what information I thought was most useful and applicable.

The Warren Buffet Way

I love reading and learning about other successful people. I'm always hoping that just a little bit of what they have that makes them successful will rub off on me. Of course, when you think of successful investors you probably think of Warren Buffet, the second richest person in the United States. His net worth is over $40 billion (can you imagine?) so he must have been doing something right with his investments.

Apparently, Buffet followed in the ways of Benjamin Graham, who I had not heard of before but is considered to be the "Father of Value Investing" and wrote the highly influential book called "The Intelligent Investor," which is next on my books to listen to. Graham's method of investing is called "Value Investing" and taught that one should only buy shares in a company that are selling below their true value. Simple, right? But how exactly do you determine if a company's stocks are selling at a bargain price?

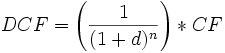

Buffet determines the value of a company by estimating the future cash flows of a company and then adjusting for the time value of money (or discount rate) based on the rate of a long-term U.S. bond. This is called the discounted cash flow and can be calculated with the equation below:

AGH! Equations, I know. I apologize for that. This is what equations do to my head: All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

Moving on.

Buffet is able to determine the future cash flows of a company by only focusing on companies that he understands and that have had consistent earnings power in the past. By focusing on companies that have consistent earnings and on companies where he understands the business he feels he can eliminate much of the risk that he can confidently project earnings into the future.

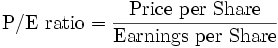

For those of us who aren't Warren Buffet and who don't have the experience of reading tons and tons of financial statements over many years, there are a bunch of ratios that people can use to determine if shares appear to be underpriced. The most popular one is the price to earnings ratio that I mentioned in a previous post. The P/E ratio can be computed:

P/E ratios are useful in comparing stocks between like companies, say if you are trying to decide between buying a share of Coca Cola or a share of Pepsi. The lower the number the better. Basically what it means is that if the P/E ratio for Coke is $10 you are paying $10 per dollar of earnings and if Pepsi has a P/E ratio of $15 then you are paying $15 per dollar of earnings.

Have I confused you yet? I think I'll leave it at that for now as all the numbers and equations are making my head spin. Please note that I am by no means an expert but rather I'm still trying to grapple to understand most of this myself. If you notice anything that is grossly erroneous, please let me know and if I make absolutely no sense, let me know and I'll try to clarify.

The good thing about trying to write this is that I can try to fill in the gaps in my understanding and I am learning a lot as I go. I hope you are getting something out of it too.

Tuesday, March 07, 2006

Investing in Stocks: Part III

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment