Tonight I sat in on a very introductory course on real estate investment. A lot of the stuff I already knew but one thing that struck me as unusual was one of the property types he suggested for beginners. In addition to the usual suggestion of purchasing a condo, a single family home, a multifamily home like a duplex, or a small retail space he suggested buying a post office.

I didn't even know that you could buy a post office. I assumed that the government would own the building and the land that they operate the post office on, but I was wrong. Anyone can buy a post office and lease it out to the U.S. government.

Think about it. What a sweet deal that would be! The biggest drawback that I have always envisioned for owning investment real estate is that you have to deal with people, people who don't pay their rent and who don't care about maintaining the property. If the U.S. government is your tenant most likely they are not going to be throwing wild parties and they will have the money to pay you rent (well, lets hope so because if they don't we're all in trouble).

Here are some of the advantages to owning a post office:

*Rent to a Stable tenant

The U.S. government usually signs 5 year leases so you are guaranteed the income for at least 5 steady years. Most post offices tend to stay in the same location year after year. When was the last time that your post office moved?

*Tenant responsible for all expenses

You won't have to worry about them running up the electric bill because they have to pay for it.

*Post offices are everywhere.

This means that there are plenty of cheap locations to choose from.

*Easy to manage.

Post offices are pretty self sufficient so there is no need to hire a property management company that will cut into your cash flow. Also, you can buy out of state and not worry about having to visit the property often.

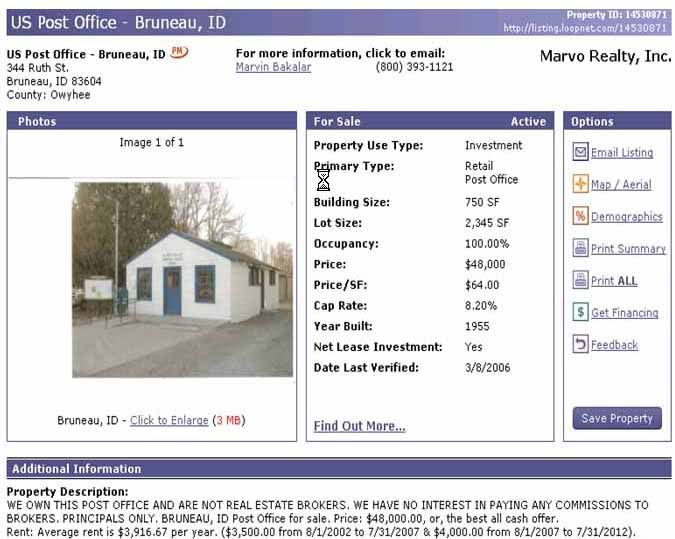

A quick search on a commercial real estate search engine produces this affordable post office in Idaho. Only $48,000 to buy with an 8.2% CAP rate (rate of return on your investment).

So it all sounds good, huh? What are some of the disadvantages?

*If the post office decideds to not renew its lease, you'll have a hard time finding another tenant to replace them. If that happens you'll most likely be able to only sell it for its land value.

*It's hard to find financing.

*The U.S. government is hard to negotiate with. You'll have a tough time trying to raise the rents on them.

Not a bad deal if you ask me. It's better than having to deal with clogged toilets and evictions.

Tuesday, March 21, 2006

An unusual real estate investment choice

Subscribe to:

Post Comments (Atom)

2 comments:

Interesting, I have never even heard about renting out a post office. I wonder why the government doesn't just cut out the middleman and buy the land and buildings. Guess that is why they are in SERIOUS debt.

Congrats on the Money magazine mention. I posted a picture of the article for you on my blog!

Later

People who have formal education regarding real estate through a real estate investing course have that much-needed advantage over the others who might still be confused regarding this matter until now.

Post a Comment