So far I've talked about choosing a good broker and reading a company's financial statements but haven't gotten into the really fun stuff yet. I've been reading lots of books from the library and listening to audiobooks about investing and I have to say that there are so many ways to evaluate a stock that I don't really know where to begin. I don't want to bore you with a bunch of terms and ratios. Those kinds of textbook explanations are much harder for me to understand and digest than an explanation that is dynamic and uses tangible examples.

The best way I think I can synthesize this information is to just break it down by the main points of each book and what information I thought was most useful and applicable.

The Warren Buffet Way

I love reading and learning about other successful people. I'm always hoping that just a little bit of what they have that makes them successful will rub off on me. Of course, when you think of successful investors you probably think of Warren Buffet, the second richest person in the United States. His net worth is over $40 billion (can you imagine?) so he must have been doing something right with his investments.

Apparently, Buffet followed in the ways of Benjamin Graham, who I had not heard of before but is considered to be the "Father of Value Investing" and wrote the highly influential book called "The Intelligent Investor," which is next on my books to listen to. Graham's method of investing is called "Value Investing" and taught that one should only buy shares in a company that are selling below their true value. Simple, right? But how exactly do you determine if a company's stocks are selling at a bargain price?

Buffet determines the value of a company by estimating the future cash flows of a company and then adjusting for the time value of money (or discount rate) based on the rate of a long-term U.S. bond. This is called the discounted cash flow and can be calculated with the equation below:

AGH! Equations, I know. I apologize for that. This is what equations do to my head: All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

All this equation is doing is putting the future earnings into today's dollars plus the amount of interest that it could have earned if you had bought government bonds.

Moving on.

Buffet is able to determine the future cash flows of a company by only focusing on companies that he understands and that have had consistent earnings power in the past. By focusing on companies that have consistent earnings and on companies where he understands the business he feels he can eliminate much of the risk that he can confidently project earnings into the future.

For those of us who aren't Warren Buffet and who don't have the experience of reading tons and tons of financial statements over many years, there are a bunch of ratios that people can use to determine if shares appear to be underpriced. The most popular one is the price to earnings ratio that I mentioned in a previous post. The P/E ratio can be computed:

P/E ratios are useful in comparing stocks between like companies, say if you are trying to decide between buying a share of Coca Cola or a share of Pepsi. The lower the number the better. Basically what it means is that if the P/E ratio for Coke is $10 you are paying $10 per dollar of earnings and if Pepsi has a P/E ratio of $15 then you are paying $15 per dollar of earnings.

Have I confused you yet? I think I'll leave it at that for now as all the numbers and equations are making my head spin. Please note that I am by no means an expert but rather I'm still trying to grapple to understand most of this myself. If you notice anything that is grossly erroneous, please let me know and if I make absolutely no sense, let me know and I'll try to clarify.

The good thing about trying to write this is that I can try to fill in the gaps in my understanding and I am learning a lot as I go. I hope you are getting something out of it too.

Tuesday, March 07, 2006

Investing in Stocks: Part III

Saturday, March 04, 2006

Recovering from your mistakes

We only get one life. That's why it is so frustrating when you've made mistakes with the life that you were given. No one is perfect; we are all bound to make mistakes sooner or later. But sometimes it seems that the mistake of getting into debt is costing me too much of my life. The effects of debt have had repercussions on my life for years and will continue to cause repercussions for many years to come.

In ways, getting into that much debt (in May 2004 I had over $30,000 of debt) is one of the best things that have ever happened to me. I know it sounds crazy but I truly think that it had to come to such a dramatic climax to help me understand how important it is to save money for the future. Who knows when I would have realized the need to start saving for a house, retirement, etc. without it coming to that point.

Then again, I'm frustrated that all of this effort and sacrifice is being made just to pay off obligations; obligations that have left me with no real assets (except for my car, which doesn't really count because it is always depreciating). Wouldn't it be great if that $30,000 that I started off with could have been saved as part of a down payment for a house or the seed money for my own business?

Enough of that negativity! Gosh, talking about debt can be depressing sometimes. The most important thing to take away from this is what we can learn from our mistakes and how we can make up for the time it has cost us to repair those mistakes. Let’s face it. Anyone in debt like me has more of a disadvantage than someone who was smart with his or her money to begin with. So how can we make up for lost time? Here are some of the tips that I have come up with to take control of our financial futures:

1) Have a master plan.

The plan should not only include how and when you get out of debt but also what you are going to do after you get out of debt. This could include saving for a house, a business, emergencies, retirement, or all of the above.

2) Educate yourself.

Read tons of books (from the library). Read lots of blogs (especially mine!). Keep up with the news. Take a class on something that interests you. Getting educated not only helps you make more informed decisions but it will also keep you motivated to do the right thing. Besides, if you are constantly engaged in ways to better yourself, you will be less likely to be at the mall spending money.

3) Network with like-minded individuals.

People with similar goals will keep you on track and will hold you accountable for your actions. Not only that, but you can exchange ideas and assist each other in accomplishing your goals. I recommend that if you are also struggling to get out of debt to join the No Credit Needed Network. NCN has recently gotten himself out of debt and has started the network to encourage others to do the same. Imagine, a whole network of people cheering you on to attain your goal.

4) Always look for ways to learn a new skill or improve on your skills.

Having a large skill set will help increase your income earning potential. Whether it is by taking a class or by engaging in a hobby that helps you practice a skill (like blogging) you will be glad you did it. You never know when an opportunity to practice that skill might present itself.

5) Think big.

Most people laugh when I tell them that I want to buy a chateau (stop giggling!). It sounds so big, so unattainable but that is precisely the point. I probably could never have kept up my motivation to get out of debt if the end goal was to only get out of debt. Boring, right? There have been many times when I wanted to rebel and go on a wild shopping spree but then looked at pictures of chateaux and realized that my dream would be that much further away if I did. Dreams have to be big in order to keep inspiring us.

Debt can be the biggest blessing in disguise if we learn from it and vow to improve our finances. If you aren’t in debt, learn from my mistake and don’t do it!

Remember: “Success seems to be connected with action. Successful people keep moving. They make mistakes, but they don't quit.” ~ Conrad Hilton

Monday, February 27, 2006

Investing in Stocks: Part II

It has been one crazy week! I don't even know where all of the time went between working and class and everything else that life has thrown at me in between. Sorry for the lack of updates...I promise to do better!

Next month, my company is going to hold a training class for the staff on how to begin investing in real estate (i.e. how to buy your first home, whether you should buy a singe family home or a 4-plex, & how to buy a small commercial building). This should be great blog material. Look out for that in the near future.

But let's get back to investing in stocks which is the topic du jour. Now that we've picked an online investment firm, we need to understand what a stock is.

This may sound very elementary but understanding this basic principle is crucial in allowing us to make informed decisions when we invest in the stock market. So please, bear with me!

Basically, when you buy stock you are buying partial ownership of a company and therefore a claim on it's future earnings. The more stocks you own, the more say you have in how the company is run and are the larger your claim is on the company's future earnings (paid out in dividends). The more the value of the company grows, the higher the stock price is likely to go, thus allowing you to sell your stock at a later time for a higher price. Conversely, if the value of the company declines, you will not be able to sell your stock for as high a price as you bought it for and you will lose money (boo).

Therefore, when you buy a stock you want to know as much as you can about the past and future potential earnings of the company so you can gauge how safe your investment is and what the potential for return is. Learning about the past financial history of the company is the easy part. Predicting the future...well that's another story. So let's start with understanding the past.

All corporations are required to issue financial statements to investors at least once a year. Once you are able to read these financial statements you will be able to make a more educated decision on whether or not a stock is a good investment or not. The 4 important financial statements are:

Income statement: Records the revenue and expenses and provides the net income or net loss for the year

Cash Flow Statement: Records where cash is being spent and how they are financing business operations

Balance Sheet: Records all of the company's assets, liabilities and stockholder's equity

Retained Earnings Statement: Records how much of their Net Income was paid out in dividends

Financial statements are available for all companies if you go to NYSE website. Simply go to the "Listed Company Directory" and pull the "SEC Filings" for the company you are interested in.

The information in the financial statements allows investors to calculate different ratios that can measure a company's performance (i.e. Earnings per share and Price-Earnings ratio), track the company's revenues, and see how much debt the company has, among many other things.

Knowing what everything in the financial statements means will probably take lots of time, but reading through even at a high level will give you a greater sense of the operations of the business, how the company intends to grow (if at all), and how profitable the company is.

It can be fun to read through financial statements randomly. I would recommend to think of a product you love, or an industry that you are familiar with and read through some of the annual reports for those companies. You will probably learn a lot!

Next: What to look for in a company...

**Disclaimer: Please keep in mind that I am by no means an expert in investing in the stock market. Quite to the contrary! These are just my general findings as I educate myself on how to invest wisely so please, take everything I saw with a grain of salt. And I'd love to hear your opinions and advice from your own experiences!

Monday, February 20, 2006

Investing in Stocks: Part I

Investing in the stock market can be a scary thing. It is something that I've heard about a lot but never actually took the time to understand. Part of the reason why it seems so difficult is because you may not know where to start.

Do you start by looking up ticker symbols and viewing graphs and charts that mean absolutely nothing to you?

Do you start by reading about companies and industries and what is going on in the market as a whole?

Do you start by looking up definitions and terms so you might stand a fighting chance of understanding investment jargon?

NO.

Personally, I think the first move that someone interested in investing in the stock market should take is to choose a brokerage firm where you will conduct your business of buying and selling stocks. Why is it so important? Well for starters, for every transaction that you conduct you will have to pay a fee. The total amount of fees that you pay for buying and selling shares could have a significant impact on your total overall return on your investment. The amount that you are willing to pay may vary depending on any number of factors including how often you want to buy/sell, how much you are investing, and what kind of tools you are looking for to research and track your investments.

For the beginning investor (like myself) there are a number of online investment companies. Each one offers a different fee schedule, different plans and research tools.

Sharebuilder: Offers the lowest fees for trading that I have found so far. There are 3 levels of accounts:

Transferring money is simple. You can link it directly with your checking and savings account and transfer money online. Under the basic plan you set your investment plan to do everything automatically for you.Basic: $4 per investment, $15.95 for a real time trade (buying or selling a stock at the current market price), and $19.95 for a real time trade limit order (buying or selling at a specific price).

Also includes a Portfolio Builder tool which recommends stocks based on a simple survey that tests your risk tolerance, goals and experience.

Standard: $12/month which includes 6 free investments per month + $2 per additional, $14.95 real time trade, $18.95 real time trade limit order.

In addition to the Portfolio Builder you get a Gain & Loss tracker which tracks the performance of your stocks.

Advantage: $20/month which includes 20 free investments per month + $1 per additional, $11.95 real time trade, $15.95 real time trade limit order.

In addition to the Portfolio Builder and Gain & Loss Tracker you have access to a tool that tracks your capital gains for tax purposes and an IPO (company's first sale of stock) priority notifier.

For example, let's say that you have $100 to invest every month. You can create your own custom portfolio and have it invest in those same stocks every month (or every week). You can also set it up so that you can make a one-time investment. The only problem that I have is that investments can only be made on a Tuesday so if it is Wednesday you will have to wait nearly a week to buy (unless of course you want to pay the $14.95 for a real time trade).

Also, I decided on Sharebuilder because of a promotion through Costco where new members earn $65 just for signing up for an account and conducting their first transaction. Can't beat that if you are already a Costco member and are interested in beginning to invest.

Ameritrade: There is only one type of individual investing account. They charge $10.99 per internet equity trade which includes stop and limit orders.

Their fee structure seems to be a lot trickier. For instance, the $10.99 fee for trading only applies to stocks being traded online. If you decide to do it over the phone they will charge $14.99 and if you want to talk to an actual broker it is $24.99 for a market order and $29.99 for a limit order. OR if you want to trade a mutual fund rather than a stock you will be subject to a whole different fee structure. And it doesn't end there. They will charge a $15 maintenance per quarter if the liquidation value of your account is below $2,000 in addition to the normal trading fees.

Bottom line that they will probably find a way to charge you for anything and everything they possibly can.

Ameritrade offers a variety of tools, some of which come with a fee. Some of the complimentary services they provide are the Ameritrade Streamer which gives you customizable real time streaming quotes and the Quote Scope feature which will give you the best bid and offer and last trade prices for a stock and displays such things as the Liquidity ratio and Flow indicator for your selected stocks. There is also the Advanced Analyzer which tracks the performance of your portfolio for $19.99/month.

Scottrade: As with Ameritrade there is only one level of account. They offer $7.00 online trades, $12 for a limit order and a minimum of $500 to open an account. They do not charge inactivity fees so that is a plus. Reading some customer reviews I noticed many people had the complaint that they had lots of technical errors (servers crashing, website being frequently unavailable) which would be frustrating if you are used to have 24/7 access to your accounts. The layout of their website leaves much to be desired; searching for info on their fees and services is quite a challenge. From what I can tell they offer the following research tools:

Scottrade: Online portal to track your account including news alerts, access to stock quotes and research.

Scottrader: Live streaming quotes, Top Ten lists and interactive charts, personal stock lists and Quick quotes to track individual stocks.

Scottrade Elite: Free if your account value is over $25,000. With this tool you can get Dow Jones News, Comtex News, advanced charting capabilities, and technical analysis.

Plus they were rated 6 times in a row for Highest Investor Satisfaction with Online trading services.

Well, I'm sure there are lots more that I haven't covered yet like E*Trade, Buy and Hold, etc but you get the idea of what types of things to consider when you are on the hunt to find a right match for your investment needs.

Sunday, February 19, 2006

"Make More" to Get Out of Debt

There are two parts to getting out of debt and to saving money in general. They are "make more" and "spend less". Making more without spending less will never result in an increase in net worth. Alternatively, spending less without making more is a good start, but will never help you achieve your maximum potential.

The posts on this blog have primarily focused on the "spend less" part of the equation and recently I have felt that there are not many more ways I can cut back on spending without resorting to eating nothing more than beans and rice, taking public transport and living in a cardboard box. A girl has got to have her limits.

The best part about focusing on "making more" is that there is no limit to how much you can make. Depending on your skills and your willingness to take risk, you can make millions with luck, a good idea and hard work. Granted, most of us will not make millions (darn it) but the point is that how much you earn is entirely up to you whereas spending less is limited to the amount of money you already have.

For years I avoided thinking very much about money because I thought only greedy people thought about money a lot. Then, as you already know, I got myself into loads of debt, over $30,000 by the time I graduated from college in 2004. (I've only been tracking the amount of debt I had since I started this blog last year but yes it was much more to begin with!)

Being in debt has taught me a lot about what money really means. It's not about buying new cars, clothes and jewelry, although it can be for some people. What I have realized is that having money is more about having freedom. The freedom to do what you love, help others and be happier as a result. Now, I don't feel so guilty about thinking about ways to make money because I've learned how it feels to be powerless without it.

There are so many ways to make money but most people only focus on the one tried and true way: getting a job. I'm sure this does not apply to some of you. Obviously if you are reading personal finance blogs on a regular basis you have an advantage over the average person. Nonetheless, I want to take a beginners approach to all the myriad ways a person can increase their income while at the same time spending less.

I'm thinking of doing a series of articles taking each topic from beginners level to advanced. Maybe something on investing in stocks, real estate, starting a business, advancing your career.

What do you think? What would you like to see? Obviously, I'm not an expert in any of these fields (yet) so if you would like to contribute, let me know!

Friday, February 17, 2006

First trades on the stock market - yay!

My first transaction with Sharebuilder went through this week. I decided on investing in the S&P 500. I actually didn't give much thought to what investment to go with. I contemplated doing hours of research but didn't think that I would be too savvy any time soon. I vaguely remember reading something that the S&P 500 has consistently outperformed actively managed funds and thought that it would be a overall safe choice for this testing period. Also, I heard somewhere that if you really over analyze your decisions, you are more likely to make a bad decision than if you go with your gut. No serious. Read about it here.

The problem is now I find myself wanting to check it all the time. Definitely not good for someone with OCD, like me. :) But what is great is that I qualify for the $65 ($55?) account promotion since I have now completed my first transaction.

Thinking about stocks and how relatively uneducated I am with the lingo, I decided I would add a new feature called "Definition of the Week" to encourage me to learn about the technical aspects of investing and finance. Hopefully, it will prove to be useful.

Today was another Friday payday. All of my additional money after making minimum payments on the credit card are going directly to my savings account instead of straight to the credit card. This way, I will be earning interest on the money instead of it paying down a balance I am not paying interest on. You'll continue to see the debt balance go down on the sidebar but I am calculating the total based off of the balance owed on the credit card minus the amount I have in my savings. I have it down to $6,488 which feels so big and so small at the same time. Sometimes I feel like I'm am trying to move mountains paying down this debt!

Sunday, February 12, 2006

Money in the Media

Aside from reading numerous personal finance blogs and websites on the internet, I am finding more and more outlets for finance related inspiration and knowledge. The wealth of information out there is truly amazing! Here are just a few alternative's to the internet:

The Suze Orman Show

Most of you have probably heard of Suze Orman before and maybe even watched her show. She cracks me up; she's like a cross between Judge Judy and Ricki Lake talking about finance. With show titles like "Confessions of a Video Vixen" you know that there is more than just straight up financial talk about IRA's, insurance and the like (and there is plenty of that too).

The Dave Ramsey Podcast

Dave Ramsey is quite possibly the King of Debt Reduction. The best thing about the podcast is his southern accent a la Dr. Phil. He's a no nonsense kind of guy. Debt is not an option. Whenever I feel like getting out of debt might not be as big of a priority as I have made it, I listen to his show. He will remind me of how important it is to make it my numero uno priority to get out of debt NOW!

Mad Money

Investment advice from a nut-case. I usually can only watch half of a show because I can feel my blood pressure go up from his yelling and screaming. But it's cool because since I know next to nothing about investing, I feel like I can glean a lot of information about what people look for when evaluating stocks. I definitely don't take his advice as gospel but its interesting to see what is being put out there as advice to investors. He also has a podcast available through iTunes.

Marketplace Radio Show

News about the economy and businesses as well as personal finance related advice. I usually listen to it on public radio but they also have a Podcast of the best of the week. You can stream the entire show from their website. Examples of current stories:

Getting a Raise: Advice from an expert at Salary.com.

Emergency Savings: Tips on how to save for a rainy day.

ETFs: Buzzword of the week.

No Credit Needed Podcast

One of the first PF bloggers that I know of to branch out to podcasting. Very well put together, reminiscent of Dave Ramsey. He talks about his own experiences of recently becoming debt free and advice and his weight loss goals. And theres just something endearing about the southern accent.

Those are just some of the alternatives I find to the standard website. What do you recommend?

Tuesday, February 07, 2006

What is in my wallet?

Some Cap at Stop Buying Crap has challenged people to show the contents of their wallets. For some strange reason, I feel compelled to share as well. There is something strangely voyeuristic about sharing intimate banal details.

Not only that, but I rarely take the time to actually look in my wallet to see what is in there. This is what I found in the black abyss of my wallet:

Drivers License

Photos of friends over drivers license to hide my crappy mugshot. People gasp and laugh hysterically when they see my drivers license photo. It's a real tragedy.

Debit Card

Credit Card

Regal Cinema Crown Club Card

Old old old Mervyn's gift card (only has $2 but I never go to Mervyn's so it will probably stay in my wallet forever)

Costco club card

Starbucks gift card

Spa gift card

Coupon for the Limited

Medical insurance cards

Library cards (3 different cities, why?)

Ikea gift card

Petco PALS card

Dave & Buster's Power Card

Business cards

Frequent Boba drinker card (taro milk tea is my favorite)

Blockbuster card (even though I haven't been to Blockbuster for 3 years)

Southwest Rapid Rewards card (haven't flown anywhere for a long time nor do I plan on flying any time soon)

Office Depot gift card

Petsmart Pet Perks card

No no wait, theres more!

$82 cash (I have a lot of cash from a bonus I got from work, long story)

Receipts galore

Old movie tickets

Coupons (car washes, kitty litter, cat food & oil change)

Emergency contact information (i.e. relatives phone numbers from other states/countries that could help in case local phone lines are down)

Change

So I guess the real question is what don't I have in my wallet????

Monday, February 06, 2006

Random Thought

Citibank, gotta love them, has sent my credit card to me without my apartment number. Kind of annoying but not really the end of the world. I was still able to call them to make the balance transfer and they offered to overnight me my card to the proper address. "No need" I tell them, "just send it regular mail". I figured I had no need to have the card in my hand by the next day so why go through all the trouble of sending it overnight. Plus, I was afraid that I might have to sign for it and I wouldn't be there, thus causing further delays...

Anyways, I still had some extra money lying around in my checking account (its a nice feeling) however the online payments hadn't been set up for my account (there is a 6 business day delay) and as I hadn't received my card yet I didn't know my account number and thus couldn't access the auto menu where I assume I would have been given the option to pay be phone. I have gotten in such a habit of making payments to my card whenever I had the money available that I decided I might as well call a customer service rep to make the payment over the phone. Mind you, the payment is not due until 2/23 so I still had plenty of time.

The lady I talked to was rather terse and interrogated me as if I was some sort of imposter trying to make a payment over the phone but I was fine with that as I would rather her give me the 3rd degree than not care at all. After a long series of questions she says, "Now you know, theres a $14.95 fee to process a payment over the phone, right?"

What? Are you kidding me? I told her to forget it of course; I didn't want to give them my money that bad after all. I told her it didn't make any sense in the nicest way possible to which she replied "Well, we are providing you a service by offering payments over the phone." Riiiiiiight.

So when did offering ways to pay them money become a service they provide? You would think that payment is just part of the deal. My car insurance company pulls the same trick. For every payment that you make they will charge a $3.00 fee. If you want to send in a physical check, well, that is an additional $10 fee. Naturally, I do not send them any checks.

So being a little annoyed but not really mad because it really had no negative affect on me besides having to wait a few days to make a payment I started thinking. Why was I in such a rush to pay them?

Part of it is that I am paranoid that if I am late for a payment my interest rate will go through the roof. But the major reason is habit. I got in the habit of sending in payments whenever I had the money was available so that I could lower the average daily balance thus lowering the amount of interest that I paid for the month. Now that I am not paying interest, I have no incentive to make extra payments before the 12 month 0% interest period is up so I could make the minimum payment, save the rest in a high yield savings account, and then once I have built up to the amount I owe, pay it off in 1 big payment.

If I did this over an 8 month period (which is the time I estimate it will take me to pay off the remaining debt) I could end up with an extra $120, which is not a lot but is more than I would have if I paid directly to my credit card.

Sunday, February 05, 2006

$55 from Sharebuilder for Costco Members

Yesterday, as I was surfing around the blogosphere I came across a post here on a great deal from Costco.

Costco is currently offering a special for members who open a new account with Sharebuilder. Just for signing up and completing your first transaction you will receive a $55 account bonus and rebates on transaction fees (25% if executive member, 10% everyone else). If you are already a Costco member and were considering starting to invest, this is a good opportunity to get started. Check out the nitty gritty details here. Offer is valid until 4/2/06.

So despite the fact that I am still not out of debt I think I might as well at least sign up and complete one transaction to take advantage of the free money. I'm not yet sure what I want to invest in or how much I should invest but I am hoping this will also be good practice for my accounting class. Part of the class is a group project where we have to choose a publicly traded company and analyze its financial statements so it will be much more interesting if I have a vested interest in the company that we choose.

Any advice on where to start? Of course, there are the big individually traded stocks like Microsoft, Google, General Electric, Pfizer or I could go with an exchange traded fund like the S&P 500. It seems a bit intimidating now, kind of like when you first go to Vegas to gamble. I feel like when I hit buy I will be hitting the big red nuclear button of investing. I'm not sure what is going to happen but it feels nerve wrecking. :)

Saturday, February 04, 2006

Helpful Post

Just ran across this post from 2 Million Blog outlining important things to know about taking advantage of balance transfer offers to earn additional income. Great read if you are considering taking the plunge.

Click here to read the post.

Friday, February 03, 2006

Goodbye Chase...Adios Interest Payments

This morning I logged on to my online banking statement and was pleasantly surprised that not only was today Friday payday but that my tax return already went through and deposited into my account. It was a very joyous morning because with both the overtime money earned from the conference and the tax return I was able to pay off the remaining $1,500 on my Chase credit card with money to spare.

Hurrah! Hurrah! The interest payments are dead. Never again will I have to pay credit card interest (assuming of course that I am able to pay off the remaining balance on my 0% interest for 12 months card).

Only $7,500 to go until I can breathe again. As soon as the payment posts to my account I will call them to see if I can do the 0% balance transfer for 6 months to my account and move the money to my ING savings account. And yes...I promise to be careful! I will beat them at their own game.

I started my accounting class this week and so far I am fascinated. I know that sounds totally nerdy to say but it's true! What is wrong with me? Whenever I tell people that I am taking an accounting class they look at me with pity. Hopefully, I'll be able to maintain the enthusiasm throughout the course, but from what I can tell it will be immensely useful to not only my professional life but my personal finances as well. After I get out of debt I want to start investing in the stock market and the best thing about accounting is that it teaches you how to read financial statement so you can make wise decisions on whether to invest in a company or not. So stay tuned...

Sunday, January 29, 2006

Balance Transfer Complete!

It's official. I've transferred over $7,500 of my debt to the Citibank card leaving only $1,499 on my previous card. With the transfer, I'll only be paying about $5 per month on interest instead of about $30 and it puts me closer to being able to use my credit line for my devious money making scheme using those 0% interest checks from your credit card.

Here's the plan. Once I have $0 on my credit card with the credit line of $23,700 I can use one of those checks that gives you 0% interest for 6 months to put directly into my savings account. The credit card company will charge $50 max for the balance transfer and that would be the only fee I would have to pay as long as I paid the money back within the 6 months. I would write the check to myself for $23,000 and sit on it for 5 months to give myself a bit of a cushion. Even better, if I deposit the money into my ING Direct account it would earn me 4.75% interest until April 15, 2006 with their promotional Winter Save Up Sale. Assuming that it takes me another month and a half to pay off the remaining $1,500 on my card, the money could be deposited in the ING account in 2 months. Unfortunately, that would only leave me about 15 days to earn at the higher rate, but so be it! Even after that date it would be earning at the regular savings rate of 3.8%. That would earn me over the 5 month period a little over $314 or $63 a month. Not bad for doing nothing at all.

Tomorrow is the first day of classes. I'm nervous to go back but also excited to see what it will be like. Wish me luck!

Tuesday, January 24, 2006

Debt as a Mental Prison

I'm not sure if you've been able to tell in my tone, but man, this debt has been taking a great toll on my mental stability. I've compared myself to a hermit, in private thought of my life as a hell, then moved on to thinking of it more as a form of purgatory, a limbo stage that I must pass through before I can move on to a brighter future. It got me thinking about the psychology of debt and how it is affecting all of the other areas of my life.

For example, work is the one element in my life that is most directly related to getting out of debt. I loathe going to work everyday because I feel like it is a form of punishment for my debts. I get frustrated with work because it is not helping me get out of debt fast enough and I feel like I am trapped working there because of my debt. No matter how much I don't like going there everyday, I feel like I have to because if I don't, the debt will only get bigger and bigger.

How messed up is that?

Another example. Like I posted before, I feel like my social life is suffering because of the debt. I can't go on vacations. I can't buy new clothes. I can't spend money to go out and do fun things. Any sort of pleasure that involves spending money is laden with guilt.

Realizing all this, I know that I cannot constantly be looking towards my "life without debt" as the oasis on the horizon. I have to stop using my debt as an excuse for why I can't do this or I can't do that. Debt is just one aspect of my life and it shouldn't rule all of the others. So hurrah for me, tomorrow is a new day!

On another note, a while ago, I was selling lots of books and CDs on Half.com and Amazon. I managed to make some extra cash that way and get rid of lots of clutter. I had totally forgotten that I still had stuff listed on Half.com until yesterday when I was checking my online bank statement and noticed a deposit from Half.com. I was confused because it had been months since I sold anything and just assumed that I had forgotten that there was any money in my account and this was just old money. I checked back at half.com's website and saw that there were 4 books that had sold in January. Being the ditz that I can be at times, I thought "Oh January, those must be the old ones and marked them all as shipped". Duh! I guess I have no concept that the month we are in now is January! Maybe this is part of the problem of living in California; every month of the year seems to be exactly the same. I then realized that I would have to go back and issue a refund for each of the books that I sold because I gave all the ones I didn't sell to the Good Will but of course, I had another blond moment and checked on "issue full refund + return shipping" charging my account more than the amount that the buyer had actually paid. Oops. I guess lesson learned; if you're going to sell stuff online you must remember to take it off once you no longer have it!

Monday, January 23, 2006

Back to the Real World

It feels good to be back at home after being at work for a few days straight. The hotel was amazingly nice and being around so many people with so much money was both depressing and inspiring. It was like living in a parallel universe where people go in and fold the toilet paper on the roll into a little tip every hour and where you are rubbing elbows with people who made $7 million dollars in just one year. Its depressing because you know that they could pay your debt and would never notice that the money was ever gone. Inspiring because you see how these are normal people and perhaps you can do it too.

I saw the guy who co-authored the Millionaire Next Door. I was looking forward to hearing him talk but ended up being bored out of my mind. I felt like I was in a college lecture hall as he was talking about his book. If you've already read the book than you pretty much already know what the guy is about (living below your means, love what you do, etc). On the other hand, I was blown away by Nido Quebin who wrote "Stairway to Success". Wow, talk about motivational. He managed to get people pumped up without being cheesy or corny. It makes me want to have him on speed dial every time I get discouraged to remember to keep truckin on.

That is the problem with those motivational speakers. The effects are usually only temporary. But I am still psyched that the debt keeps going down, I'm close to being under $9,000! As soon as I got back I did my taxes and figured out that I paid waaaaay too much on my taxes. I was really trying not to. I used the IRS tax calculator to see if I was overpaying so I could adjust it but it said I would only end up with a $200 refund so I never changed anything. Come to find out that after I did the federal file that I should be getting back $820 and $120 from the state. It will be nice once I get the money to be able to put it all towards my debt but it would have been even nicer to have had that money earlier so it could have already been paid down!

Monday, January 16, 2006

Debt Hermit

I realized something about myself today. I have become a debt hermit. I came upon this realization today when I went to the mall to pick up a pair of pants that had been tailored. While I was there I decided to go into Forever 21 to look around. I told myself that I was just going to look to see if they had a shawl or something to wear with my dress for Saturday night but ended up finding a few casual tops that I wanted to buy. I thought I really needed these tops because during the conference I'll be forced into situations where I will have to wear non-work clothes and wanted to look nice. For any of you that know Forever 21 you will know that everything is inexpensive and cheaply made so a few tops would have probably cost $50 tops. I had everything ready and was walking to the checkout stand when my logical, frugal self took hold.

I realized I didn't really need these clothes but rather that buying the new clothes was part of a coping mechanism that I use for facing social situations. Somehow I feel much better about being social with people when I am wearing new clothes and if I feel that I have nothing to wear, I will avoid the situation at all costs. This is partly how I got into so much debt in the first place. If I had a date I would have to buy a new outfit. If I was going out with friends I felt the need to buy something new. Now, since I can't run out and buy a new outfit on every occasion (nor should I ever even if I didn't have debt) I avoid the situations and stay at home as much as possible.

I know part of my shopping neurosis is imagined whereas part of shopping neurosis is very real. People are judged so often by what they wear, what they drive, what latest gadget they have that I don't wonder why people have so much debt from trying to live up to what people expect them to be. I think I felt this pressure much less when I lived in northern California because people were much more laid back there.

So I wonder, if they had a map showing the areas with the highest concentration of debt-laden individuals, where would they be?

Tuesday, January 10, 2006

New Credit Card & balance Transfer

Today, I applied for a new credit card. Yikes! O.k. it's really not that bad. I signed up for a Citi Platinum Select MasterCard and was approved for a $7,500 limit. The great thing about this card is that you get 0% APR for 12 months on balance transfers with no balance transfer fees. That means that once I transfer over the $7,500 I will only have $2,293 at 3.99% APR to pay for the rest of my debt-ridden life. Over the long run this will probably only save a little over $100 but any bit helps and it will help me pay it down faster. I have not received the card yet and before I transfer any money I am going to call them to make doubly sure that there are no hidden fees. I will keep you posted.

In other "news", I have been stressing out about my company's upcoming National Conference. This is where all of the nearly 800 people from the company fly out to California to meet, network and get pumped up about the coming year. Of course, being in the real estate industry which is very sales and all about appearance and projecting an image of wealth and prosperity, there is pressure to look your absolute best. The girl in me feels the need to go out and buy a whole new wardrobe so that I feel like I will be suitably dressed but my extreme guilt about spending money on anything but the necessities is holding me back. I think that is part of what got me in this debt in the first place (the feeling that the outfit, the hair, etc will make me feel more confident and more at ease). One thing that I have to buy for sure (theres no getting out of this) is a dress for the black-tie event. Ugh. I hate buying dresses, especially dresses that I will probably never wear again. SIGH.

The one thing about the conference that I am looking forward to is our keynote speaker, William Danko, who is the co-author of The Millionaire Next Door. I really enjoyed the book and I am interested in what he will have to say.

One other good thing about the conference is that it will mean lots of overtime, not nearly enough considering I will be there from Wednesday to Sunday. But any extra money will mean that the debt will go down faster!

Monday, January 09, 2006

Save Karyn

My favorite radio show in the world is To The Best of Our Knowledge. Every week they interview people about a theme. These people can be authors, musicians, artists, or just people with an interesting story to tell. This morning, I was listening to an older program that dealt with shopping. Of course, no discussion about shopping is complete without throwing debt into the equation.

They interviewed someone who was in a similar situation to myself. She was young (in her 20's) and had found herself in over $20,000 in credit card debt after she moved to New York and succumbed to the extravagant lifestyle. After she lost her job and could pay her bills anymore she became determined to pay off her debt and started a website called Save Karyn. She basically asked everyone to donate money to her cause and amazingly enough, people actually gave her money. She is now debt free thanks to her savings effort and through the generous donations of others. She wrote a book that I am tempted to buy all about how she got into debt into the first place and how she got out of it by "internet panhandling".

It's stories like these that give you that "why didn't I think of that feeling". Actually, I did think of it, but my pride wouldn't let me turn this blog into a donation center. It's funny to think that this approach actually worked for someone and now they are debt free and selling books! Maybe I should have been asking for donations all along...

Thursday, January 05, 2006

Going back to school

I finally registered for my one and only class for the Spring 2006 semester. I struggled with how many classes to take. I figured I should just stick with one class so that I don't feel overwhelmed and so I can figure out if I am going to like it at all. I was shocked at how expensive it was, $132 for one class at the community college. I didn't apply for financial aid because I figured that I would qualify and that it would only cost about $60. Comparatively, to what I paid at the UC system it doesn't seem like a lot but I can remember when the cost per unit at a community college was only $13 (and this was only about 4 years ago). Now the cost per unit is double that, $26. Yikes!

Hopefully, this new path will steer me towards greater financial independence at a quicker rate. Lords know I'm never going to get there with my current salary. I can't wait!

Saturday, December 31, 2005

Things I Learned From 2005 & The Years Accomplishments

What did 2005 teach me?

1) Determination can accomplish anything.

You cannot be crippled by overwhelming situations. The only way to change things is to take a deep breath, develop a plan, and stick with it. It's been hard; it's been a pain but that will make it way more satisfying when I am finally debt-free.

2) Support makes the journey more bearable.

I want to thank each and every one of you who visit this site and offer words of encouragement and advice. Before I started this blog I felt all alone. My debt was a dirty secret that I didn't want people to know about and the loved ones that did know about it couldn't relate. It has been great to read about people going through similar situations and learning from them as well as being held accountable for my own progress.

3) Keeping track of your finances electronically only works if you keep a back-up.

After my laptop died in July, I lost all of my financial info that I saved in Quicken. Oops! I learned you need to keep a copy somewhere other than your hard drive. I wanted to be able to do a year in review but I'll have to make due with what I have.

4) Don't expect to get the raise you deserve without asking.

I posted here before about my 4% raise but I didn't post about how they increased my raise to 9% when they feared me leaving for another job. I was a bit jaded along with a few other employees; word got around and well they increased my raise. I wasn't happy with how it happened. I should have told them straight up that I thought I deserved a bigger raise without all the drama that ensued from me not speaking up. It wasn't a monumental raise but it was easier than finding a new job. Lesson learned.

5) Consolidate student loans early.

I didn't look into consolidating my student loans until after it was too late. I thought since I only had one payment that I didn't need to worry about it. Alas, I was wrong and if I had consolidated just a few weeks earlier I could have locked in a smaller interest rate.

6) Commuting is a waste of time and money.

I am so glad I made the decision to move closer to work. I don't have as much money to pay back towards my debt but I am able to make it worth it by cutting down automotive related expenses (gas, maintenance, depreciation), working more overtime, and being able to go back to school to increase my earning potential. Plus, eventually I would probably eventually run up lots of medical bills with stress related illnesses.

7) PPO is not the right option for me.

Some people really like having a PPO. It is nice to be able to go to almost any doctor you want, when you want until you have a major medical catastrophe and you are responsible for 20% of your medical expenses. I never knew how much X-rays, diagnostics tests and hospital stays could cost until I had to pay 20% of them. As soon as I was able to, I switched to an HMO.

2005 was a good year for me. Here is what I was able to accomplish:

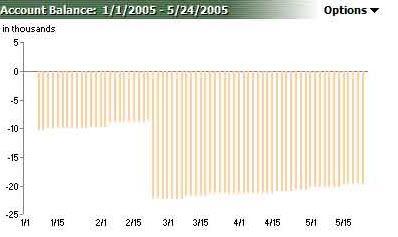

1) Since the beginning of the year I have paid off more than $13,000 of credit card debt. I wasn't able to create a comprehensive graph showing the progress but I found this old graph from one of my first posts:

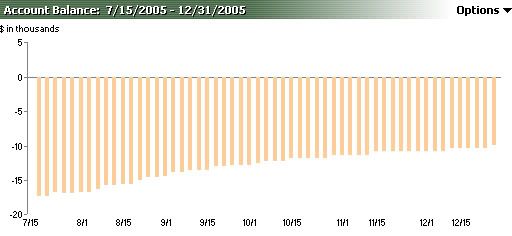

and a new graph that shows my progress from July 2005:

The spike in the first graph comes from when I transferred my car loan to my credit card using a low interest balance transfer check. So in 2005 I consolidated my credit card and auto loans and reduced the amount of interest I was paying every month while making it easy to aggressively pay down the debt.

2) Paid off $1,250 of my student loan debt. Not a huge amount because I was focusing most of my energy to the credit card.

3) Saved nearly $2,000 for retirement in my 401k. Again, not a lot but it is something. Next year I will be 20% vested in my company's matching so I will have even more.

4) Weathered a major medical expense without having to rely on credit cards. Who knew that having an appendix taken out could result in more than $2,000 in medical expenses? No more PPO for me.

5) Moved out of the family home and got my own apartment. Bought furniture and all the other comforts of home without having to put a single dime on my credit card.

All in all this year has been most productive and I feel it can only get better in the future. Here are my New Year's Resolutions for 2006:

1) Pay off credit card by September 1, 2006.

This will require me to pay a little more than $1,000 towards my debt every month. Right now I have been having a slightly difficult time finding the $1000 to pay every month but I think I can do it if I try harder.

2) Continue to save for retirement and stay at my job until I have at least reached the 20% vested mark.

3) Go back to school and complete at least two courses that I think would be interesting and beneficial for my future.

4) Once the credit card is paid off, focus on the student loans with as much intensity as the credit card.

5) Learn more about investing.

6) Increase savings in both savings account and CDs.

I find it almost therapeutic to look back on the year, both at what went wrong and what went right. It's by learning from our past mistakes that we grow to be better in the future! Hope everyone has a safe and prosperous 2006!

Wednesday, December 28, 2005

The Grocery Game

I was recently reading an article on CNN Money that discussed how to Shave $150 a week off of your grocery bill. I was intrigued. Who would be able to cut that much money out of their weekly grocery bill? I probably don't spend $150 a month on groceries, let alone $150 per week. The gist of the article was to plan ahead and only buy what you need and cook meals with ingredients that overlap. Not a bad idea but nothing revolutionary. One of their suggestions though, did pique my interest. They suggested to make a game out of grocery shopping and reference a website called The Grocery Game. I had to check this out.

Basically, The Grocery Game is an online subscription service that provides weekly lists of items on sale in your local area. The list is broken down into color coded items; green are free items, blue are the "best deals for stockpiling", and black are items you should buy only if you need them.

It sounds like a good idea but I'm hesitant to try it. It would save a lot of time on cutting coupons (I don't really use coupons anyways) but it also seems pointless to spend money to save money. The subscription is $10 every 8 weeks...working out to be $1.25/week. That is not a huge amount of money but would it ultimately be worth it?

The problem I find with grocery coupons is that name-brand items with coupons work out to be just slightly less (if not more) than generic store brands. Why spend time and effort to buy name-brand items at a discounted price when you can buy the generics, which are basically the same thing, at a lower price without the coupons?

I'd love to hear what others think. Are you a coupon-clipper? A faithful consumer of generic products? Or maybe a little of both?

Monday, December 26, 2005

2006 - The Year to be Debt Free

Looks like 2006 will be the year that I finally become credit card free. It's hard to imagine a life without credit card debt hanging over my head. It has been nearly 5 years since I got myself into this mess; practically my entire adult life has been spent with a credit card bill. Let's just say that it will not be missed.

I've finally got the debt to under $10,000. Losing a digit feels awfully nice. Since May when I started this blog I have almost cut my debt in half! Not too shabby for 7 months of hard work.

As the new year approaches, many of us will be thinking of our New Year's resolutions. Here are ways to make sure that we stay on track to achieving our goals (Source).

Constantly Evaluate Your Progress

Having an action plan is not enough. The captain will have to constantly evaluate his progress in order to be sure he is on target. Unforeseen obstacles are sure to arise, such as a hailstorm, or increased southerly winds. As a result, he may have to increase his speed or guide the boat in a more westerly direction. In other words, notice what is working and what is not. If an approach is not working, don’t waste your time with it. Change your approach.

Never Lose Sight of Your Goal

Take the time to review your goals every morning when you get up and every night before you go to bed. This will keep them fresh in your mind. If you think reviewing your goals twice a day is too much to ask, maybe you should reevaluate what it is you want. Ask yourself, “How important is it to me that I attain my goals?”

Don’t Procrastinate

Procrastination is a “silent killer”. Understand that the only way to achieve your goals is to take action! Knowledge means nothing if you don’t apply it. How many people have you come across with an unbelievable amount of education working a mediocre job? The world is full of people who don’t apply their knowledge. On the other hand, chances are you know of people with less educational background who apply everything they learn. These people are usually the ones who are most successful in all areas of their lives. Do something right now that will help you to achieve your goals. There is no time like the present! Get the ball rolling. Each step you take brings you one step closer to the life you want. Remember the motto, “The road to Someday, leads to the town of Nowhere”. Someday is today!

Finally, you ought to have your key goals in front of you on a regular basis. You should look at them at least weekly to ensure you are making progress and to see if you need to modify your plans in anyway.

I hope everyone is having a safe and fun holiday!

Wednesday, December 21, 2005

Move on Up or Move on Out

Today was just one of those days. I had one of those moments when I was able to step back from my life and look at it objectively from someone else's point of view. When I thought about it, I really had to ask myself, "WTF are you doing?" You know its never a good feeling when you have one of those moments.

I have to admit that my job is not terrible and I am not paid terribly. I could continue working there forever living this mundane existence and getting by with modest salary raises. A job is a job; it pays my credit card bill and the rent. I could try to look for another job but I feel like that would be just trading in old problems for new problems. I've looked around at job postings online and I just feel like I'm not qualified for any of them. How could I have gone to college and graduated with a degree, had a high GPA and still not be qualified for any of these jobs that I know I could do in my sleep. Where are the jobs that require a degree in Anthropology!

Better question, why did I think that getting a degree in Anthropology would be a good idea? I thought I could be a professor, until of course that I realized that I am terrible at explaining things, hate talking in public and despise "academia". Anthropology would have been a great idea if someone would just pay me to read books, contemplate life and maybe one day, write a great book.

So after a day of nearly quitting my job, coming home and looking at jobs and becoming thoroughly discouraged at my prospects, I decided that it was due time for me to sign up for classes to gain some real skills (mad skills if you will). I've been thinking about it and procrastinating for a while. Today was the last straw and I am on my way. I am going to take an intro class in Accounting just to see if I like it. I have always thought that accounting would be really boring, but after starting this blog and pouring over my finances, I realized that it really might just be the thing for me. Plus, when I buy my chateau and have my B&B I will keep awesome track of the books. If I end up realizing that it truly is boring, what the heck. At least I can then scratch it off my list of possibilities.

Friday, December 09, 2005

Change of Address

Little did I know that merely updating my address would save me $57 a year! I have changed my address pretty much everywhere except my auto insurance company. I knew I had to do it but it was one of those things I kept putting off and then forgetting to do. So today I sat down and called the company and updated my address and the rep told me that it would save me $57 a year. The rest of my payment for this policy term will be prorated so I will pay less for the next 3 months! Sweet. I'm mad at myself that I didn't do this sooner because I could have been saving money months ago!

Monday, December 05, 2005

No luck in Vegas

Well I made it back from Vegas in one piece. Too bad I can't say that same for my wallet. My dreams of winning the jackpot and paying off my credit card in one fell swoop were never realized. I actually came back -$100 from gambling. At one point I was up about $75; I should have called it quits while I was ahead, but you know it never works that way. It was just too easy to sit down at a machine and lose $20 in the blink of an eye. I would look at the other people gambling that had sat at the same machine for goodness knows how long and wonder how much money they were losing by the minute. So depressing to see all that money and have none of it be yours!

We did eat lots of good food, saw a cool show and had a great time. So all in all it was a good trip and I'm glad we went. Hopefully, I will have that bug out of my system and can go back to focusing on paying off my debt. I learned on Friday before I left for Vegas that they were going to increase my bonus so I don't feel so guilty for going anymore.

Christmas is coming up so I'm a little worried about that eating up money for my credit card. This year, my family decided to do a secret santa gift exchange in the place of buying a Christmas present for everyone. That is a great relief because not only is it stressful to try to find that perfect gift for everyone in the family but it is expensive too! I feel that gifts should come from the heart throughout the year when you can afford it, and not just from obligation because it is Christmas. I'm hoping I will be able to find that one special gift for someone that they will truly appreciate!

Monday, November 28, 2005

Laziness and Guilt

I must be in one of those debt reduction rough patches. It is getting hard for me people! I think part of the reason I stopped updating this blog is due to laziness. It is tough always trying to think of new things to write about, not to mention having to write about it! Another big component of it is being in a new environment. Once we moved into our new apartment I kind of just lost interest. I'm not sure what it is about the new apartment but it just feels different when I post on the blog.

But most importantly, I think the biggest reason why I haven't been updating is GUILT. I have some confessions to make. I have fallen off the debt-reduction wagon. Once we moved I had to spend tons of money on new things for the apartment. I stopped caring about being frugal. If I wanted a new coffee bean grinder, I bought it. Why? I don't know. Because I wanted it! I wanted new clothes, so I went and bought those too. And rent is not cheap! My last paycheck was the first paycheck that I did not take money out of for the credit card. It was a tough decision for me but if I had put the usual $500 towards the credit card I would have no money left for Vegas.

Yes, thats right. I said it. VEGAS. I am finally taking a vacation. It has been so long since I have done anything fun that I figured I might as well live a little. I'm scared I'm going to look back on my 20's and remember only the sweat and toil of paying off my stupid credit cards.

But paying off my credit card is still a huge priority to me. I think I've just got to find some good balance between LIVING and paying off debt.

Sunday, October 30, 2005

Finally...

I got the internet back! We are all moved into our new apartment. We have most of the furniture and amenities of everyday life all set up now so I don't really feel like I am living at a hotel. All of that stuff cost tons of cash and I must say it was kind of addicting spending all of that money. Imagine having to buy nearly everything for your apartment...we bought a couch, a chair, an entertainment center, a dining room table, a bookcase, not to mention the dishes, the towels, the rugs, etc etc. Once I broke through that mental barrier of not being able to spend money, I was buying stuff left and right. I have got to get back to my normal frugal self, especially now that I will have rent to pay. It will not be easy but I still think my goal of getting out of debt in 2 years is still feasible. Only 11 more months to go and I will be debt free!

Wednesday, October 19, 2005

I haven't given up...

Don't worry, I have not given up blogging. I have been internet-less at home for nearly 2 weeks now and only have access at work. We hope to have internet again in 2 more weeks once we have moved into our new place and have gotten everything hooked up with our new interent service provider. So it might be a while before things resume again as normal but I will be back! And I'm still on the path to a debt-free life despite the fact that I have not been blogging!

Sunday, October 09, 2005

Checking In

Sorry all for the lack of posts. A huge rant will be coming soon but suffice it to say for now that Verizon is the devil. My internet works only when it wants to and Verizon doesn't really seem to care at all. I have cancelled my service effective 10/13 and can't wait to sign up for SBC Yahoo once we move.

The move is only 2 weeks away so we are busy buying all the stuff that we need and getting rid of all the crap we don't want to bring with us and trying to get some cash for it. Amazingly someone bought my ancient SNES for $40 from Craigslist and I've had luck selling other random stuff on Ebay so that is helping out.

We are slowly getting all the stuff we need for our new apartment. We bought our sofa and chair yesterday and got our pots and pans, cutlery and George Foreman grill from Amazon yesterday for $100 because they were offering $25 off when you spend $125 in their Kitchen and Housewares Department. I'm slowly getting over my "spenders block" but it still is tough for me to make a solid decision on buying items. They opened a brand new Target by my house and it's my new favorite place. I went there two time yesterday to look at stuff for the apartment but ended up not buying anything but kitty litter and cat food. Their Home furnishings department is huge and they have a much bigger selection than any other Target I've ever been to. For some reason though, I can't just buy the towels because I think "is this really the best buy on towels??"

Anyways, like I said, I'll probably post a huge rant against Verizon soon but I just can't do it right now. The thought of reliving those traumatic events is too much for me right now. :)

Sunday, October 02, 2005

Mr. Wendal

The other day, I was listening to some old music in my music library and happened across the Arrested Development song "Mr. Wendal". Remember that song? It was big back in its day. I still love it. I love most of their songs really but when I listened to it again some points really resonated with me.

Here, have a dollar,

in fact no brotherman here, have two

Two dollars means a snack for me,

but it means a big deal to you

Be strong, serve God only,

know that if you do, beautiful heaven awaits

That's the poem I wrote for the first time

I saw a man with no clothes, no money, no plate

Mr.Wendal, that's his name,

no one ever knew his name cause he's a no-one

Never thought twice about spending on a ol' bum,

until I had the chance to really get to know one

Now that I know him, to give him money isn't charity

He gives me some knowledge, I buy him some shoes

And to think blacks spend all that money on big colleges,

still most of y'all come out confused

Mr.Wendal has freedom,

a free that you and I think is dumb

Free to be without the worries of a quick to diss society

for Mr.Wendal's a bum

His only worries are sickness

and an occasional harassment by the police and their chase

Uncivilized we call him,

but I just saw him eat off the food we waste

Civilization, are we really civilized, yes or no ?

Who are we to judge ?

When thousands of innocent men could be brutally enslavedand killed over a racist grudge

Mr.Wendal has tried to warn us about our ways

but we don't hear him talk

Is it his fault when we've gone too far,

and we got too far, cause on him we walk

Mr.Wendal, a man, a human in flesh,

but not by lawI feed you dignity to stand with pride,

realize that all in all you stand tall

For me, I think it really resonated with me because I realized how this journey of getting out of debt has really changed me as a person. I feel like I am finally able to get off the treadmill that people run on, trying to always have the newest car, the right clothes, and a house full of crap only to find out that what they have now acquired is "passé" and they have to buy all new crap to keep up. Its good for me to step back when I'm thinking of buying something, and think that a large portion of the world lives without a lot of the crap that I take for granted, things like hot showers, running water or even food to eat.

This new "simplicity" approach to life is much saner for me. It feels good to have less stuff crowding my life (by the way I just sold some more stuff on ebay and got about $50). I think once I have my debt paid off I will finally be in control of my life. I'll have the control to make smarter career choices, the control to help people and the control live the kind of life that I want to live. That's what money is there for, right?

Tuesday, September 27, 2005

Spending Block

I think I have finally broken through a case of what I call "spender's block". Think of it as "writer's block" but instead of not being able to write, you're not able to spend money.

For months I have been wearing the same UNCOMFORTABLE shoes to work. They are awful. The toes are so narrow that I feel like I am doing permanent damage to my feet by wearing them by disfiguring them into an un-foot like shape. I keep wearing them because I don't want to spend the money to buy new shoes. I know I have to buy them eventually; I've looked at Target for cheap shoes that were comfortable from time to time but never find anything. Finally, yesterday I figured that since I had that $2.00 gift certificate to Mervyn's that I should try to look there.

I looked and looked for shoes that I thought were both stylish (because I am oh so stylish) and comfortable. There were these hideous looking shoes that I tried on that felt so good that I almost bought them despite the fact that I would look like I was 80 years old wearing them. There were also these shoes that were so-so but I couldn't bring myself to buy shoes that were so-so because I knew I would be wanting to buy another pair in a couple of months becauase I hated the so-so shoes.

So I crossed shoes off of my list and thought that perhaps I could spend my $2.00 on something for the new apartment. I looked at towels. I looked at dishes. I looked at appliances. But I just couldn't buy anything. The thing about Mervyn's that bugs me is that all of their prices are jacked up and then they say that everything is 40% off so that you feel like you are getting some fabulous deal. I wasn't going to play that game. In my head I kept thinking, I could probably get that at Target for cheaper. So, before I made any RASH decisions with my $2.00 I decided that I would think about it and shop around first.

So when I got home I went to Target to compare prices on things like dishes, pots and pans, silverware, etc. It got to be so frustrating because almost none of the products had all good/average reviews. It seemed inevitable that each product had a comment like "i put these in the dishwasher and they fell apart" or "this blowdryer burnt my hair and I found clumps of hair on the bathroom floor". Yikes! Sometimes I think that product reviews really help but at the same time makes it soooo much more difficult to choose.

So what do I do? Instead of making a decision, I head on over to Amazon to see what they have. Even more choices! And to make things even more complicated, Amazon is offering $25 off

when you spend $125 in their Kitchen & Houseware or Bed & Bath departments. I could easily do that in this whole moving process (not that I want to).

What is a girl to do? Who knew that buying cutlery could be such a process. Why can't I just muster the courage to buy a toaster?

The good news is is that I at least found a cute, comfortable pair of shoes today. Bad news is that they cost $75. I'm o.k. with it though because shoes are the one thing that I would prefer to spend a little bit more on so that I know that they will be comfortable and will last longer (crossing my fingers on that one). Also, when I got home my neighbor had dropped off a nice toaster and some silverware that they no longer need. So maybe spender's block was a good thing!

Sunday, September 25, 2005

Why I should clean out my desk more often

Today I have been in clean up mode in preparation for the move. I've been trying to go through and get rid of stuff that I don't use or don't need any more so that it won't be such a chore when we have to pack up all of our stuff in boxes. Today, I turned my forces to the desk drawer, a virtual black hole apparently. I rarely use this desk drawer and things that get thrown in here are mostly forgotten...until I decide to do a major clean. I was shocked to find:

1) An expired $5 Borders gift certificate

2) An expired $2 Best Buy rebate

3) A valid $10 Barnes & Noble gift certificate

4) A valid Mervyn's gift certificate with a $2.87 balance

5) A Nordstrom's gift certificate with $0 (you must imagine how excited I was at the prospect that it still contained a balance)

6) An old photo that I thought I had lost and was glad I didn't

Wow! I guess that teaches me a lesson. I have a really bad habit of letting papers accumulate and pile up and telling myself that I will get to it later. Obviously I don't otherwise I would have not let that $7 go to waste. But I'm stoked about finding the gift certificates that are still valid! Ya!

Saturday, September 24, 2005

Money & relationships

I know that the #1 cause for divorce is money problems. So I am kind of worried about moving in with my boyfried. We've never had any issues with money before because we've never really had to split bills before or make decisions together. Now that we are moving in together those days are over. He's already driving me crazy because he just doesn't get me. He is one of those people that would rather pay the extra money to avoid the additional effort while I am the total opposite. I would much rather get a better deal and incur a little bit more inconvenience.

Exhibit A:

He doesn't want to bother looking around for cheap/free furniture on Craigslist or at yard sales. He would rather spend a lot of money on furniture that looks nice and will last than search for a good deal. I really don't see the point in spending tons of money on furniture until you buy a house you are going to stay in for a while. Why? Because we may need to move again and I don't want to worry about having to find a place that will be perfect for our furniture or worry about trying to sell it if it doesn't fit or whatever. I would rather feel comfortable just getting rid of it if something did happen.

Exhibit B:

He doesn't think that a savings of $10 off of our cell phone bill is a lot of money and is not worth the effort of switching.

Exhibit C:

He wants to buy a brand new car instead of buying one that is 1 or 2 years old simply because he can't say that it's brand new. I don't understand why you would rather pay thousands of dollars in depreciation rather than own something that someone else has already driven.

Exhibit D:

When we go to the grocery store he will grab the first thing he sees instead of comparing brands to see which is cheapest or what is on sale.

Eventually I think it will drive ME insane that he doesn't care where his money goes and it will drive HIM insane that I am always looking for a way to save a buck here or there. Aye carumba! What am I getting myself into?

Friday, September 23, 2005

25 Signs That Show You Know How to Handle Money

I randomly came across this article while searching for inspirational money quotes (per Donald Trump's advice of course). After reading it, I realize I still have a lot of work to do!

According to Al Jacobs, here are the 25 Signs That Show You Know How to Handle Money:

1. Your credit card bill is paid in full each month with never a penny in interest incurred.

We all know how I stack up on that one!

2. You understand that the variable annuity in which your neighbor just invested will prove to be a sad mistake.

What is variable annuity?

3. Despite orchestrated furor by the media, you recognize that the $30 it costs to fill your vehicle’s gas tank is cheaper in today’s dollar that the $15 it cost 20 years ago.

Ya! At least I get this one. Doesn't mean I like it (I'm not complaining either though).

4. You enjoy financial talk shows for their entertainment value while knowing that 95% of what’s said is nonsense.

I've never actually seen a financial talk show? They exist?

5. The only type of life insurance that you’d ever consider purchasing is a term policy.

No kids; haven't even thought about it yet but I vaguely remember that those terms you pay into that are same as cash after X amount of years are a rip-off.

6. You’re not tempted to invest in something because of a hot tip you get from a friend or relative.

I'm not tempted to invest in anything yet!

7. You have serious doubts that the 3-unit course in basic English composition offered at Eleganté University for $900 is any better than a similar course conducted at Midtown Community College for $60.

Oh yes, I'm totally feeling him on this one.

8. You are sufficiently sophisticated in real estate to know that the worst house in the best neighborhood beats the best house in the worst neighborhood.

Mmmhmmmm.

9. You owe nothing on the vehicle you drive.

Wellllll, technically I don't. But realistically, all the money on my credit card is actually my car loan.

10. You have a pretty good idea by mid-November how much your income tax obligation for the current year will be.